Pelosi's Stock Trading Controversy Haunts Democrats as Jeffries Denounces GOP Freshman’s 'Theft'

Congressional stock trading sparks bipartisan outrage as Rep. Bresnahan faces allegations of breaking campaign promises.

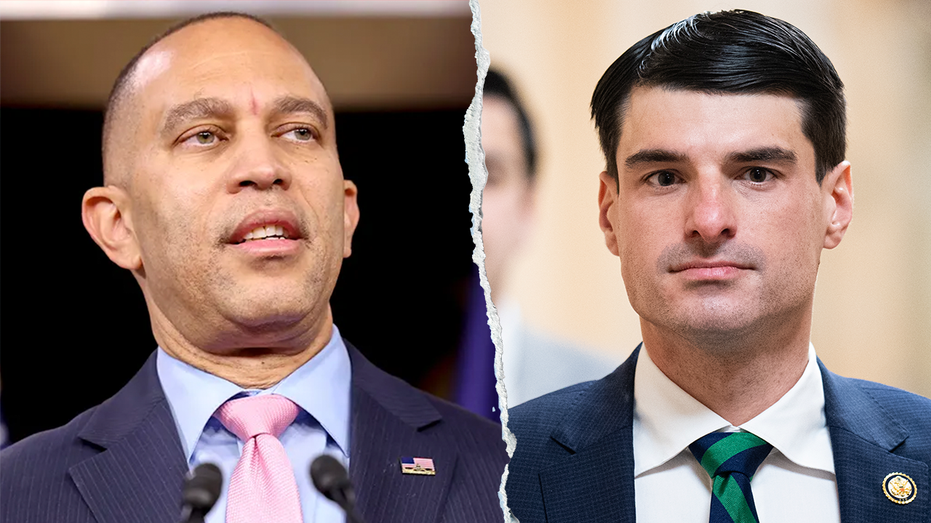

The debate over congressional stock trading reignited this week as the National Republican Congressional Committee (NRCC) accused House Minority Leader Hakeem Jeffries of "hypocrisy" for criticizing freshman GOP Representative Rob Bresnahan's financial activity, despite similar controversies involving prominent Democrats. The NRCC highlighted what it called a double standard, pointing to years of scrutiny surrounding Democratic lawmakers and their families engaging in stock trades while in office.

"It’s rich for Hakeem Jeffries and national Democrats to suddenly care about stock trading when their real leader, Nancy Pelosi, and members of their own caucus make traders on Wall Street look like amateurs at a penny arcade. This political pandering is lame," said NRCC spokesperson Mike Marinella, underscoring a growing frustration among Republicans who feel the issue is being weaponized for political gain.

Rep. Rob Bresnahan was thrust into the spotlight after several news reports revealed that he continued trading stocks even after entering Congress and pledging to ban such activity. Notably, after introducing legislation to ban congressional stock trading and promising to set up a blind trust, Bresnahan reportedly persisted in his investment activities—a move drawing ire from both sides of the aisle. In response, Jeffries condemned what he called "thievery," accusing Bresnahan of profiting while "everyday Americans struggle to live paycheck to paycheck" and vowing to end what he described as "blatant corruption" if Democrats regain a majority in the House.

The controversy is far from unique to one party. Members of Congress, regardless of affiliation, have repeatedly been criticized for buying and selling securities—transactions that can intersect with sensitive, non-public information gained through their work. Senator Josh Hawley, a Republican, has reintroduced the so-called "PELOSI Act," designed to bar lawmakers and their spouses from trading stocks while serving. The bill's name references former Speaker Nancy Pelosi, who herself has faced frequent scrutiny over her family's financial dealings.

Nancy Pelosi’s husband, for example, sold more than $500,000 worth of Visa shares not long before the federal government initiated legal action against the company—a trade publicly disclosed under the Stop Trading on Congressional Knowledge (STOCK) Act but still fueling perceptions of impropriety. Other Democrats have come under fire as well. Representative Vicente Gonzalez of Texas denounced tariffs implemented by former President Donald Trump, only to buy significant amounts of Apple stock afterwards. Gonzalez and others, including Representatives Jared Moskowitz and Julie Johnson, reportedly bought and sold major stock holdings on days when market volatility was expected due to policy shifts or public statements.

House Democrats have pushed back against what they describe as deflection tactics by Republicans. Justin Chermol, spokesperson for Jeffries, responded by declaring, "House Democrats will not be lectured by a Republican Party that has openly embraced corruption in the Trump administration, the Supreme Court and the Congress.” Chermol also challenged Republican leaders to bring meaningful stock trading reform to a vote, suggesting that their reluctance to do so reveals the partisan nature of the debate.

The record makes clear that both parties have struggled to address the optics and ethics of stock trading by members of Congress. As calls escalate for stricter rules or outright bans—with bipartisan bills regularly introduced but rarely enacted—the issue remains a lightning rod, fueling public skepticism about the intersection of wealth, privilege, and political power in Washington.